By the identical token spending off personal debt to the relinquished residence could also trigger a tax. So be cautious, and do the job along with your tax professional or economical advisor in advance of including personal debt into your 1031 Trade approach.

He followed up with me by cell phone the following day to examine on her. I enormously appreciated the non-public Get in touch with and observe up. I have made use of this service in past times and may continue to take action when needed

A 1031 exchange allows you to defer funds gains taxes by reinvesting the proceeds in the sale of an expenditure house into the acquisition of One more investment residence.

Getting personal receipt in the proceeds of the initial sale is a big no-no and will quickly result in the funds gains tax liability, regardless of whether all one other 1031 Trade rules are followed.

Really don't forget about DSTs. Several investors right now struggle to find appropriate replacement Attributes. A DST, or Delaware statutory have faith in, is usually a fractional desire within an institutional high-quality asset owned passively and it is supplied by a housing syndication commonly referred to as a sponsor.

The demanding 1031 Trade procedures require the new investment decision home to generally be of equivalent or greater benefit than the property being marketed. Furthermore, for a complete tax deferral, the complete proceeds in the sale has to be utilized to acquire the more info second assets.

The IRS states that you can only total a 1031 exchange involving like-kind properties, which it defines as currently being of the identical mother nature or character, regardless of whether the Homes differ within their Over-all good quality. What this means is you have to swap just one method of investment or organization housing with A further.

Construction needs to be completed by the end of the 180 days. “An improvement Trade permits customization to fulfill your specific wants, although it’s intricate and needs exact management,” Latham claims.

When homeowners offer housing which includes greater in price since they purchased it, they need to fork out funds gains tax on their revenue.

Do you want to have the exchange method started with the financial commitment residence or do you may have questions about if a 1031 exchange is ideal for you?

IRC Segment 1031 has lots of shifting sections that real estate traders will have to realize in advance of attempting its use. An exchange can only be designed with like-form Qualities, and Inside Profits Company (IRS) guidelines limit its use with getaway Attributes. There's also tax implications and time frames Which may be problematic.

The exercise could when applied correctly contribute towards the expansion of real estate portfolio of rental housing. Crucial to the achievement of the approach is efficient management of your asset and timing the moves nicely To make certain the transaction is entire and The brand new assets has respectable income movement.

Portion 1031 from the IRC defines a 1031 exchange as any time you Trade genuine house employed for business or held as an expenditure only for one more organization or expense house that's the exact same sort or “like-sort.” As being the code would make apparent, serious Houses are normally seen to be like-form, and the vendor of a business property can efficiently defer the coming from the Tax Person by investing the proceeds with the sale into a subsequent business enterprise residence.

Do you need to obtain the exchange procedure started out using your financial commitment home or do you may have questions about if a 1031 Trade is best for your needs?

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Katie Holmes Then & Now!

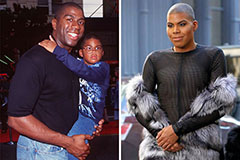

Katie Holmes Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!